Red meat insights

Posted on Tuesday, 24 September 2024

Whilst we are not out of the woods yet, with the worst of the winter blues behind us, we expect to see an increase in livestock numbers flowing through the plants and an improved ability to meet demand.

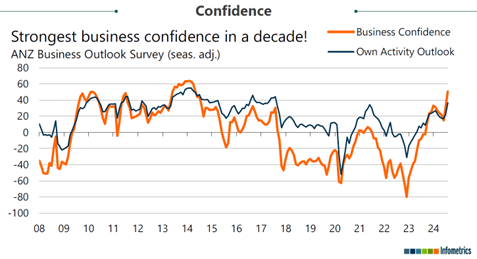

At a broader level, there are also early indications of some greener shoots appearing in the NZ economy. Brad Olsen from Infometrics recently presented some encouraging and cautiously optimistic economic commentary including ANZ’s latest business confidence survey which is reporting the highest outlook for business confidence in a decade.

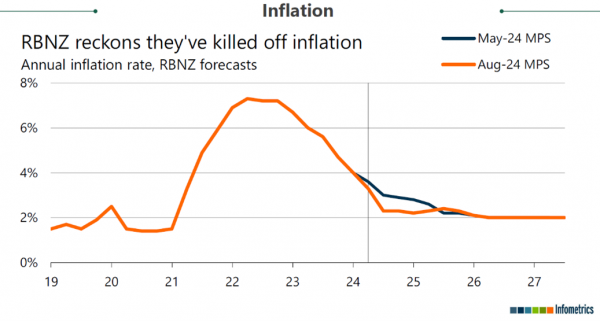

This coincides with the RBNZ’s own claims that they have broken the inflation bubble, and we are fast heading towards the target range.

Clearly the global and domestic economic pressures aren’t done with us and not likely to be so for some time, however it is good to feel there is at least some indication that we may have weathered the worst of it and there is potential for upside ahead.

Published 24/09/2024

Spring update

The ANZCO domestic red meat team have been very busy over the past month micro-managing supply as we worked our way through the annual plant shutdowns and the off-season supply conditions. Thanks for working with us.

From a pricing perspective, the large volumes of product dropped into the domestic market appear to have been working their way through the local supply chains and we are starting to see some signs of firming as the impact of the seasonal lower kill profile take effect. This will also likely lead to some tightening of beef prime cuts availability through the remainder of September and into October.

Published 15/09/2023

April market chatter

Following a short period of respite whilst some larger parcels of export-bound products were redistributed into the domestic market, at a local level we are beginning to feel the effects of prices firming in the US market. It's fair to say demand from export markets is more steady than heavy however with the winter supply slow-down coming ever closer, it’s unlikely we will see any decline of note in our own market pricing as we seek to secure our share of the reduced production.

With our domestic red meat sales team now actively out and about in the market, the message we are receiving from our Food Service customers is consistent regarding increased operating costs and continued labour challenges. Nonetheless, whilst most remain upbeat in terms of current patronage and sales revenues, they also share concern that the ongoing inflationary pressures and associated hit to the back pockets of consumers will eventually force a reduction in non-essential spend leading to additional challenges that must be managed.

In terms of our Manufacturers, we are seeing caution in managing raw material stock levels and forward forecasts – no doubt in anticipation of the predicted market downturn and higher holding costs. Whilst a prudent approach in some respects, given the supply chain and logistics challenges we continue to experience, running to a JIT (just in time) inventory profile can sometimes result in missed production and revenue opportunity.

Outlook for the New Year 2023

Perfect storm for NZ consumers in 2023

Lamb is back on the menu for Christmas in many New Zealand households as retailers take full advantage of a sharp rebound in lamb pricing. A recent strengthening in the NZD/USD combined with a lift in the kill, subdued export demand and higher poultry and pork prices has created the perfect storm for the NZ consumer.

Export markets have continued to show significant pushback in recent weeks, especially on lamb and, more recently, beef round cuts. Traditionally, competitive tension between US and China would cause commodity beef prices to lift as we head into the New Year, however, with South America experiencing a bumper season, both markets have been buying volume at rates significantly lower than prices seen out of New Zealand.

Cheap lamb prices seen out of Australia over the past few months haven't helped customer demand for more expensive product out of New Zealand.

It's not all doom and gloom for export as recent unrest towards the Covid-Zero policy in China may turn sentiment positive again if lockdown rules are relaxed and the food service sector shifts into gear again. New Zealand processors will be watching developments with interest.

The longer-term cattle outlook in the US isn't great as flood and drought conditions have led to the liquidation of breeding stock, not dissimilar to what we have seen in Australia in recent years. Many US customers are holding high inventory volumes (208M MT boneless beef reported at the end of October) bought at high prices, and it could take some time to move through stock as they average their costs down. It's unlikely we will see any significant price movements until Q2 as prices have already dropped faster than the schedule has, putting pressure on processing margins. USA cow kill numbers remain high at present, resulting in a lack of interest for imported product.

Back home in New Zealand, kill numbers have risen fast as new season lambs fill production lines across the country and steer numbers lift. While demand from local trade has lifted, customer buy cycles have increased because of storage constraints, mainly caused by chillers being full of hams. The supply chain will be at full capacity leading up to Christmas, so freight delays are inevitable.

For now, at least, the consumer will be happier with their basket spend at the checkout.

From the local team at ANZCO Foods, we wish you, your staff and families a Merry Xmas and a happy New Year.

Outllook for October

The weakness of the NZD/USD continues to dominate headlines as we hover near lows not seen since 2020. While this supports export returns, it doesn't help consumers in the domestic market.

The strength of the dollar is however masking some of the weaker in-market values and we have started to see the price of lean trim ease in the USA. As punters begin to tighten their belts offshore and the kill begins to lift, we expect to see pricing fall here in NZ.

Demand from China is a key focus as we enter their buy-in period for Chinese New Year. While China returns on some items have reached new highs off the back of the FX shift, we are seeing pricing ease in relative terms. Brazil has supplied significant volumes to China in recent months and sentiment is that the market is well stocked.

Lamb production for the UK/EU Christmas period will commence in October, however, with high inflation impacting discretionary spending, demand looks to be lower than we have seen in previous seasons. This will benefit the NZ consumer as offers on legs and shoulders for Christmas have been very competitive.

As the veal season nears completion, we will start to see increased beef and lamb numbers leading into November. Average lamb carcass sizes have dropped for the first time since last season and the schedule has eased to $9.55/KG, a reflection of numbers coming on. A drop-in schedule pricing is expected as processor margins get squeezed.

The P2 Steer schedule has lifted to $6.60/KG and demand remains steady from traditional markets; however, pricing has eased off the peak. Australia has started to signal strong demand for PS cuts as La Nina threatens more volatile weather conditions over the ditch which will impact supply on the local market.

The domestic market has benefited from pricing lower than export for the Winter months and while we expect to see a slight reprieve as the kill lifts, the weak NZD and strong offshore demand could hold pricing up longer than we may have seen in previous years. A lot hinges on the FX moving forward.

Outlook for September

New Zealand exports approximately 88% of bovine and 95% of ovine produced, in a sector that contributes significantly to GDP and employs approximately 92,000 people. We have a very clear understanding of export markets because of data maintained by The Meat Board, however, there is very limited data available to fully understand the scale of the NZ domestic market.

The NZ domestic market is often the most volatile that any processor deals with. Supply chain & production issues or a slowdown in a particular export market can have immediate impact on volumes shifted locally. The past season has been unlike many, in that we have seen a steady rise in pricing, often beyond the realms of where many thought it could go. This is largely been driven by strong global demand, increasing inflation, a weak NZD and a kill that has export volumes lagging 58,000MT behind last year.

Lamb

The domestic outlook for September remains challenging. Many processors will be through the peak of the veal season earlier than expected, but if adverse weather conditions continue across the country, this will not only impact lamb survival rates but it will start to put pressure on capacity. Many plants use their lamb chains to process veal during lambing season.

Average lamb CCS sizes are increasing, with more than 50% of production coming through as H grades, meaning we could continue to see more heavy legs and shoulders on the local market. Export demand for 2.7KG+ CKT Legs has dropped significantly and this is reflected in current pricing with U2.7KG fetching $1.50-2/KG more from many markets.

Beef

Strong export demand and pricing has seen beef schedule pricing reach $6.40/KG on P2 Steer and we could see this go higher as competition builds. PS round cut pricing has been at levels unseen on the local market and a strong USD isn't going to provide any support in the short term.

While Australia has been taking significant volumes of NZ beef again this season, this has now slowed dramatically as their kill lifts. This could provide some support for local customers as we head into Spring.